How West Africa’s economy is held captive by France

NIGERIA - France used to rule West Africa and most of its other colonial territories through the "Indigénat" or the “Empire of Law”. Paris exerted dominance on Africans through various cruel and inhumane laws and regulations.

The French tried to “tame” Africans through punishment, which could range from fines, to 15 days in prison or immediate execution, if they “disrespected” the French or refused to do labor. Plantations, forestry operations and salt mines became abundant across Africa where people would face death, prison encampments, forced removals, floggings, and even amputations if they posed any real or perceived challenges to their French masters. France essentially used torture and murder as an instrument of national policy and remains unapologetic despite its staggeringly harrowing actions to this day.

By 1960 France was forced to grant independence to almost all its former colonies after bloody and entrenched resistance from the locals. Even though France has largely removed its forces from West Africa after the fall of its colonial empire, thousands of French soldiers remain in Africa under the pretext of “fighting terrorism”, it continues to exploit the region by controlling the West African nations’ resources, economic structures and political systems. France decided to maintain its empire in Western and central Africa in everything, but name. But how exactly does it manage to do so?

In 2018 Italy’s Deputy Prime Minister Luigi Di Maio reiterated an accusation repeated by multiple European and African politicians that France’s policies in Africa are creating poverty and causing migration.

“France is one of those countries that by printing money for 14 African states prevents their economic development and contributes to the fact that the refugees leave and then die in the sea or arrive on our coasts,” the official told reporters.

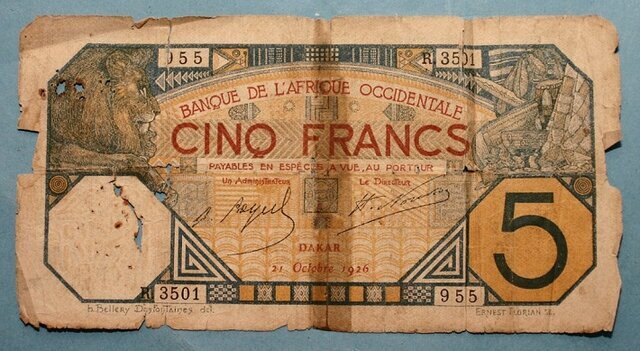

France now uses the CFA Franc to hold its former colonies in Africa at bay.

The CFA Franc, established by France in 1945, was created to regulate the cost of accessing raw materials from its colonies and protect France's interests from the UK's "sterling area" monetary bloc. Despite gaining independence from France many years ago, 14 African countries still use the outdated CFA Franc as their currency. The currency is often criticized for its significant benefits to France and the strict conditions attached to it. What France used to pitch as a humanitarian exercise is now being referred to as a tool of monetary servitude.

Two groups of countries using the CFA franc as their common currency are the West African Economic Monetary Union (WAEMU), consisting of Benin, Burkina Faso, Côte d’Ivoire, Guinea-Bissau, Mali, Niger, Senegal and Togo, and the Central African Economic and Monetary Union (CAEMU), consisting of Cameroon, the Central African Republic, Chad, Republic of Congo, Equatorial Guinea and Gabon. These two groups account for 14% of Africa’s population and 12% of its GDP.

The 14 countries in west and central Africa use the CFA Franc, which is issued by the Central Bank of France and guaranteed by the same body. The Central Bank of France has pegged this currency to the Euro at 656 CFA Francs and the French treasury guarantees all CFA members unlimited convertibility of CFA Francs to Euros.

In return, these 14 countries let the Bank of France keep their foreign currency income and gold reserves. This situation, due to the permanent parity of the CFA Franc against the euro, practically controls inflation in the economies of these countries and ensures economic stability.

what are the downsides of the CFA Franc?

Firstly, these countries have to deposit their own gold and foreign currency reserves (Euros, Dollars, Yen, Yuan, etc.) with the French Treasury and do not have the authority to manage their wealth or decide how to spend their money.

In other words, monetary policy in these countries is determined by France.

Independent economies usually use monetary policy to stimulate their own growth and economic development in various instances of recession or prosperity.

For example, during the COVID-19 pandemic, both the US Federal Reserve and the European Central Bank followed expansionary monetary policies by extensively injecting money into the economy to stimulate demand and prevent a recession (they did this by supporting industries, making new investments, and strengthening households' economies, etc.).

On the contrary, in times of inflation, they can raise interest rates and encourage people to deposit money in banks to reduce the amount of money in the economy and bring down general price levels by reducing demand.

Since these countries do not have control over their own currency, they cannot implement any monetary policies and thus have practically no control over their economies.

These countries are not allowed, for example, to convert their Euro reserves into another currency like the Dollar or Yuan when the value of the euro decreases globally, and as a result these African nations are always prone to suffering losses.

Therefore, in order to achieve economic independence, these countries must decouple their own currency from the Bank of France.

In other words, the existence of a currency unit issued for the 14 countries by France, ensures the continuation of French colonization, albeit in an economic sense, over the African continent.

And as African Franc continues to dominate several of African countries’ economies, that means none of the stated nations have fully escaped the trap of French colonization.

Leave a Comment