Sanctions incentivize formation of larger blocs: economist Steve Hanke

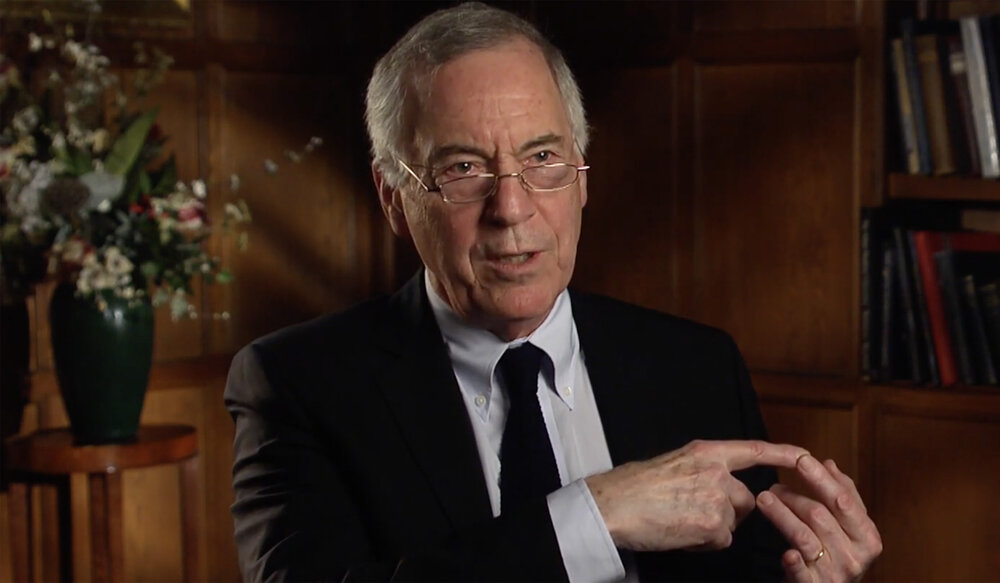

TEHRAN - A professor of applied economics at the Johns Hopkins University in Baltimore says that sanction policy leads to formation of coalitions against countries imposing the sanctions.

“Indeed, they often incentivize the formation of larger coalitions that oppose the countries that are imposing the sanctions in the first place,” Steve H. Hanke tells the Tehran Times.

“I'm opposed (to sanctions) in principle because they interfere with free trade, and I'm opposed in practice because sanctions rarely achieve their desired objective.”

While America makes every effort to pressurize some West Asian countries like Iran, Turkey and Lebanon via sanction policy and targeting their currencies, Hanke suggest these countries install a currency board that issues notes and coins convertible on demand into a foreign anchor currency at a fixed rate of exchange, in order to save value of their currencies.

Steve H. Hanke is the leading expert on hyperinflation and served on President Reagan's Council of Economic Advisers.

Following is the text of the interview:

Q: What are the main reasons for the Turkish lira crash against the U.S. dollar?

A: The main cause for the current Turkish lira crash, as well as all of the periodic crashes in the past, is the fact that Turkey has a central bank, which at present, is controlled by President Recep Tayyip Erdogan. For Erdogan, low interest rates are a fatal attraction. Just what is the source of this attraction? To answer that question, we must understand Islamic finance. It’s replete with theories about the evils of interest rates - theories embraced by Erdogan. Indeed, as he once clearly put it, interest rates are the “mother of all evil.” Yes, President Erdogan’s economic ideas are fundamentally rooted in charismatic, medieval texts that are far removed from the real world of today, or even yesterday. But as long as the lira is issued by a central bank with discretionary powers, “low” rates will result in a weak and vulnerable lira and relatively high and variable inflation rates. In other words, as long as Turkey’s central bank possesses discretionary monetary powers, Erdogan faces a dilemma.

Sanctions are for fools because they incentivize potential enemies to form alliances against those who impose the sanctions. Q: Some other countries in West Asia including Iran and Lebanon have been experiencing the same crisis in their currencies? What is the story? Is it an economic war against them?

A: There is no external war against these countries. The problem is an internal cancer, namely their central banks. Central banks are not appropriate in these countries if they want stable money.

Q: Which solutions do you recommend for these three countries generally to revive the value of their currencies? Some experts in West Asia suggest eliminating the dollar in bilateral trades.

A: Turkey, Lebanon, and Iran could save their currencies by installing a currency board. A currency board issues notes and coins convertible on demand into a foreign anchor currency at a fixed rate of exchange. It is required to hold anchor?currency reserves equal to 100 percent of its monetary liabilities, and it generates profits from the difference between the interest it earns on its reserve assets and the expense of maintaining its liabilities.

By design, a currency board has no discretionary monetary powers and cannot issue money on its own credit. It has an exchange?rate policy — the exchange rate is fixed — but no monetary policy. Its operations are passive and automatic. The sole function of a currency board is to exchange the domestic currency it issues for an anchor currency at a fixed rate. Consequently, the quantity of domestic currency in circulation is determined entirely by market forces, namely the demand for domestic currency. Since domestic money is a clone of its anchor, a currency? broad country is part of an anchor country’s unified currency area.

A currency board requires no preconditions and can be installed rapidly. Government finances, state-owned enterprises, and trade need not be reformed before a currency board can issue money. I know this from personal experience because I was the architect who installed the currency boards in Estonia (1992), Lithuania (1994), Bulgaria (1997), and Bosnia-Herzegovina (1997).

Q: Do you think the countries that have been facing U.S. sanctions can form an economic coalition to avoid negative effects of sanctions? Something like the EU or the Shanghai cooperation to encounter U.S. unilateral sanctions. Is it helpful? If yest, to some extent?

A: The question you pose to me is interesting because I am always and everywhere opposed to sanctions. I'm opposed in principle because they interfere with free trade, and I'm opposed in practice because sanctions rarely achieve their desired objective. Indeed, they often incentivize the formation of larger coalitions that oppose the countries that are imposing the sanctions in the first place.

Allow me to give you an example of how I have been actively engaged in effectively opposing sanctions. I was involved in saving the Hong Kong system from what would have been a fatal blow. One Sunday afternoon in July 2020, Secretary of State Mike Pompeo telephoned me. He indicated that the United States was going to impose financial sanctions on Hong Kong, and that a final decision would be made by President Trump the next day. But, before the meeting in the White House, Secretary Pompeo had been instructed to obtain my opinion. We spoke via telephone for 35 minutes. Pompeo was adamantly for sanctions. I was adamantly against it. Monday afternoon, the White House called to tell me, “Hanke you won. There will be no financial sanctions against Hong Kong and its currency board.”

Q: Given China's economic rise, don’t you predict this country will turn into a haven for countries that are suffering from U.S. sanctions? Don't you think the U.S. is pushing Turkey and Lebanon towards the arms of China and Russia through its sanction policy?

A: As I indicated in my response to your previous question, sanctions are for fools because they incentivize potential enemies to form alliances against those who impose the sanctions.

(The views expressed in this interview do not necessarily reflect those of Tehran Times.)

Leave a Comment