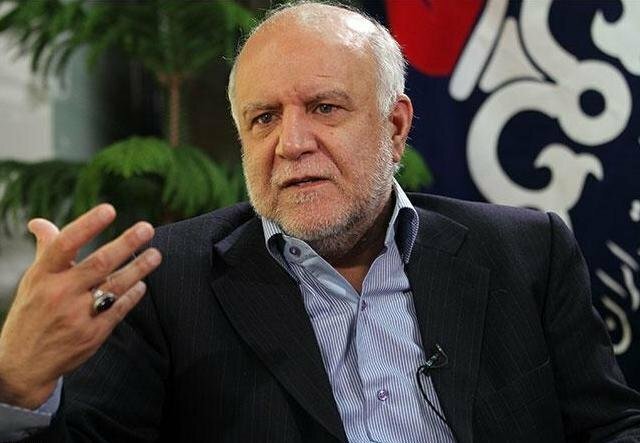

Offering oil at IRENEX to continue: Zanganeh

TEHRAN- Iranian Oil Minister Bijan Namdar Zanganeh said National Iranian Oil Company (NIOC) will continue the process of offering crude oil at Iran Energy Exchange (IRENEX), IRIB reported.

The minister said: “Offering oil at IRENEX has been somehow successful and it is hoped that by removing the barriers we can expand the offering process.”

He said offering crude oil and also gas condensate at IRENEX will continue as before and the Oil Ministry should offer specified amounts of the products each month.

The least amount of offering crude oil is 35,000-barrel and some good facilities have been set for the buyers, Zanganeh said.

NIOC offered light crude oil at IRENEX first on October 28, 2018 just few days before new U.S. sanctions on Iran’s petroleum sector took effect (November 4). In the first round, NIOC could sell some 280,000 barrels of crude oil at $74.85 per barrel. With the daily supply amount of one million barrels, the market wrapped up by selling eight 35,000-barrel cargos of oil on the day.

Then after eight rounds of offering light crude oil at IRENEX, NIOC sold 70,000 barrels of heavy crude oil at this exchange market for the first time on April 30.

Like offering light oil, one billion barrels of heavy oil was offered at IRENEX with 35,000 barrels as the least amount of sales.

Now, offering heavy crude oil at IRENEX can open a new chapter for the exports of Iranian oil as this type of crude is of high significance both technically and commercially, because it accounts for a huge amount of production in the refineries and many refineries throughout the world specially in the South Asian region are willing to use this type which has of course lower price compared to the light oil.

Since the U.S.’s withdrew from Iran’s nuclear pact in May 2018, vowing to drive Iran's oil exports down to zero, the Islamic Republic has been taking various measures to counter U.S. actions and to keep its oil exports levels as high as possible.

One of the main strategies that Iran chose to execute to help its oil exports afloat has been trying new ways to diversify the mechanism of oil sales, one of which is offering oil at the country’s stock market.

Sales of crude oil, both light and heavy types, at the IRENEX is being strongly supported by the Iranian government and NIOC is facilitating the condition for the buyers more in each round of the offering.

In this due, Export Guarantee Fund of Iran (EGFI) is going to issue bank guarantees for the customers who purchase the oil offered at IRENEX, managing director of the fund announced last month.

“We are in talks with the oil ministry in this regard.” Afrouz Bahrami said.

She noted that EGFI has received some requests for issuing bank guarantees from oil customers interested in purchasing the oil offered at IRENEX.

According to the official, EGFI covers the commercial and political risks of exports, including both non-oil and oil exports and since the oil which is offered at the IRENEX is also considered as part of the country’s oil exports, therefore it is possible for EGFI to issue banking guarantees for such cargoes.

Such supports and also offered incentives encourage the applicants of crude oil at the energy exchange and also pave the way for the country’s oil exports under the sanctions.

MA/MA

Leave a Comment