1398 budget bill, (non)-oil revenues?

The budget bill for the next Iranian calendar year 1398 (starting on March 21, 2019) was presented to the parliament on December 6 while Iran’s economy, previously expected to boom, is experiencing the toughest conditions under the draconian U.S. sanctions. The upcoming year is supposedly an economic predicament for Iranians to endure and for the government to program and handle.

Budget bill in review:

The prepared budget bill, which will be officially submitted to the parliament by the Iranian President Hassan Rouhani on December 16, is said to be contractionary.

According to official information, major policies applied by the Rouhani administration in preparing the annual budget bill include:

• reaching stable economic conditions and improvement of business environment,

• controlling unemployment rate and preserving job creation,

• providing social justice and improvement of fair distribution of income,

• managing the operating deficit, improving the balance of capital assets, and developing regional-provincial balance.

To improve general livelihood of Iranians, spur job creation, support production, and reinforce budget discipline the budget bill is aimed at:

• increasing the salaries of government’s employees and the retired,

• continuing implementation of the planned programs to combat absolute poverty and improve healthcare, and

• paying cash subsidies to qualified Iranians with lower income.

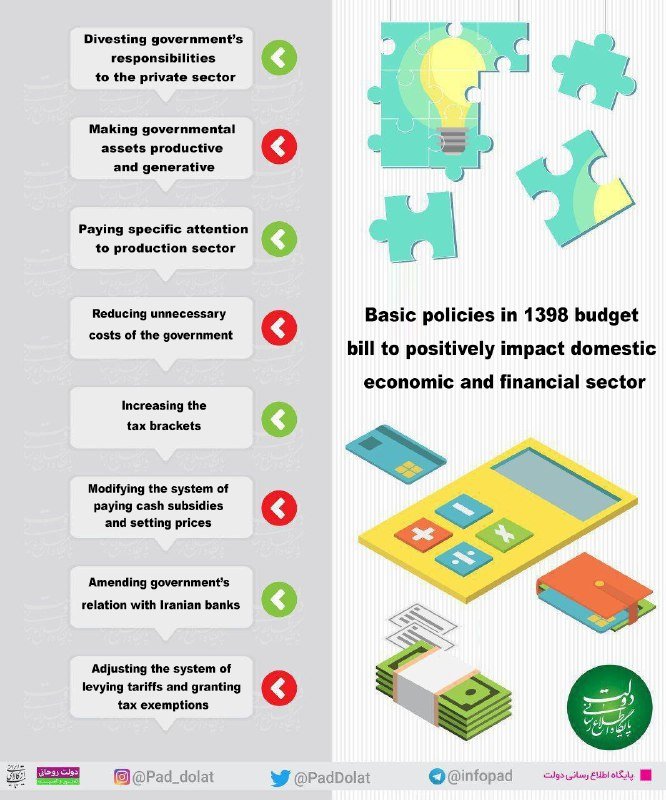

In a bid to positively impact domestic economy and financial sector, the administration has prepared the budget plan revolving around:

• divesting government’s responsibilities to the private sector,

• making governmental assets productive and generative,

• paying specific attention to production sector,

• reducing unnecessary costs of the government,

• increasing the tax brackets,

• modifying the system of paying cash subsidies and setting prices,

• amending government’s relation with Iranian banks, and

• adjusting the system of levying tariffs and granting tax exemptions.

The unique and distinguishing characteristics of the proposed budget plan, compared to those of the previous years, are its support for:

• providing social justice and improvement of fair distribution of income,

• domestic production and job creation,

• strengthening budgetary discipline,

• modifying procedures and processes, and

• most importantly increasing the stability of budget against international impetuses.

For the next year, the prepared budget bill, as the Head of Iran’s Budget and Planning Organization Mohammad Baqer Nobakht announced:

• predicts 4.33 quadrillion rials (about $103.09 billion) of income for the government from various sources including tax, divesting state-run shares, oil and etc.

• estimates a 12-pecent-growth for budgetary resources

• expects 27 percent reliance of budget on oil revenues

• forecasts 1.5 million barrels of oil sales per day (bpd) at the price of $54 per barrel

• estimates dollar exchange to stand at 57,000 rials

• foresees no growth in fuel prices and petroleum price to stand at 10,000 rials (about $0.23) per liter

• requires the government to pay 34 percent of its oil revenues to National Development Fund of Iran, according to the Sixth Five-Year National Development Plan (2016-2021)

• necessitates the government to allocate $14 billion (at the exchange rate of 42,000 rials) to supply of basic goods to back Iranians’ livelihood. The exchange rate for other goods, imports of which are confirmed by the government, is 80,000 rials.

• mandates allocation of 1.42 quadrillion rials (about $33.8 billion) for paying subsidies whether in cash or in form of basic goods to qualified Iranians

It is worth noting that all the used data and figures in this article are driven from the announcements made by Iranian officials and the administration has not released the budget bill tables.

Therefore, precise calculation of government’s income in next year due to its high reliance to international and unpredictable factors, is not possible.

Oil revenues in focus; possible scenarios

Oil revenues, as the main source of supplying budget and government’s income, stand among the major pillars in planning next year’s budget bill.

The 1398 budget bill predicts Iran’s oil price to stand at $54 per barrel (pb) and sales of 1.5 million barrels per day.

The predicted oil price in the current Iranian year’s budget bill was $55 pb.

According to the OPEC Monthly Oil Market Report (MOMER) published, Iran could sell 3.44 million bpd of heavy oil at the price of $75.20 in September, 2018, while its average production level in the third quarter of 2018 stood at 3.59 million bpd.

Last Friday and in OPEC’s 175th meeting in Vienna, OPEC and oil-producing allies known as OPEC+, agreed to cut production by 1.2 bpd and Iran was exempted from any oil production cuts. All was decided despite U.S. President Donald Trump’s tendency to avoid the cut and keep prices low.

What occurred at OPEC and the general conditions of the international oil market can be translated in different ways, regarding Iran’s ability in earning the oil revenues planned in next year budget bill.

In one optimistic scenario, future may seem bright for Iran’s oil revenues thanks to the country exemption from OPEC oil cuts and possibility of any increase in oil prices due to other oil producers’ lower production. Removal of 1.2 million barrels from the world market would help offsetting the value of Iran's lost barrels. As Reuters puts the idea in words, “an output curtailment also would provide support to Iran by increasing the price of oil amid attempts by Washington to squeeze the economy of OPEC’s third-largest producer.”

The conditions would turn more in Iran’s favor in case the U.S. and China accord to bury the hatchets and move toward less tense relations and the eight countries which are granted sanction waivers continue buying Iranian oil.

Accordingly, being able to sell more than 3 million bpd of oil at the price of $54 pb, would supposedly bring at least $59.1 billion of revenues for the country per year.

However, the dark side is probable to emerge.

The prices and the volume of Iran’s oil sales at the present time do not precisely match with what MOMER has announced (Iranian Oil Company does not publish any official figure about the volume or prices of Iranian oil, therefore, all the announced data are released by foreign resources or unofficial ones). In addition, international political and economic conditions do not seem much safe to guarantee Iran’s interests.

What has been achieved at OPEC’s latest meeting, of which Trump is not an advocate, is just an agreement signed on paper and its implementation would be compromised by any unpredicted decision or reaction of its signatories.

“There are tensions between China and U.S.,” Iranian oil expert and market analyst Mahmoud Khaghani told the Tehran Times, “and the Chinese economy is going to experience a recession, India may followingly experience such a recession, and the conditions are not much better in Europe; France is dealing with some necessary challenges.”

“This is what Trump expects to see. He wants EU to be dissolved which will automatically cross out the Petro-Euro,” Khaghani added. “The tough international economic conditions will decrease the international demand in near future, from which Iran will suffer,” he concluded.

As Iran's former OPEC Governor Mohammad Ali Khatibi told the Tehran Times, “according to Iranian officials, the country sells 3.75 million of bpd oil at the present time but rumors have it that oil sales stand at much less than the announced figure. Some even put it at around 800,000 bpd.”

“We should keep in mind that the predicted sales of 1.5 million barrels, foreseen in the next year budget, include selling crude oil in addition to the condensates,” he underlined. “Condensate prices are lower than oil prices,” he added.

“Iran’s oil prices per barrel can usually be estimated by subtracting three dollars from the Brent prices,” he said, “therefore, it presently hovers around $57 per barrel.”

In a pessimism scenario, being able to sell one million barrels of oil bpd at the price of $54 pb, would supposedly bring $19.71 billion of revenues for the country per year.

No matter what future brings for Iran, considering its oil revenues, the significant point is that the volume and prices of the country’s oil sales are not predictable. Uncertainty is never welcome in economy.

Iranian experts unanimously believe that the country should decrease its reliance on oil revenues and move toward supplying its operating budget from other resources such as exports of non-oil products, tax revenues, tourism and etc.

“The Iranian governments were expected to decrease reliance of economy on oil revenues by five percent per year. They are still on the process,” Khatibi lamented.

“Oil revenues should not be utilized as a budgetary resource but should be saved at National Development Fund of Iran or any other national fund to be consumed for improving domestic infrastructure and development,” he said.

Road to non-oil-reliant economy under construction

Iran’s budget deficit, the fruit of the imbalance between government’s costs and earnings, came in bigger than expected in the first half of the current year 1397 (March 21-September 22, 2018) to reach 372.3 trillion rials ($2.65 billion), latest data released by the Central Bank of Iran shows. The shortfall was larger than the budget law’s forecast of 164.3 trillion rials ($1.17 billion) for the six-month period while it is 105.5 percent more compared with the deficit of the preceding year’s corresponding period.

This reflects the significance of moving toward a non-oil-reliant economy for the government to be able to prevent its operating costs surpass its income and to tackle the predicted rampant inflation, increase the income of its employees and pay the intended cash subsidies to lower income-earners in the upcoming year without increasing the prices of energy carriers and fuel or levying higher taxes, which do not seem to be welcome by the Iranian nation under the ongoing conditions.

As Mehdi Karbasian, the Iranian deputy industry minister and head of Iranian Mines and Mining Industries Development and Renovation Organization (IMIDRO), told the Tehran Times in an interview, “to compensate any probable decrease in oil revenues, the government should make some changes in its foreign policies and also take some measures to attract financial resources from the Iranians who live abroad.”

“The government should create some channels for Iranians living out of the country to inject their money in form of investments, for instance, to Iran. This is what India and China have been doing within the past years,” he said, “The government can also lure Iranian businessmen, active in foreign countries, by granting them some specific credits.”

The official also referred to a new resort for the government to guarantee its revenues. “Our oil sale contracts with our customers, such as China and India, relies up to 50 percent on their national currencies which reduces competitiveness for Iran and pulls us towards exclusive supply of goods,” he said.

“Using national currencies in our financial transactions provides us a new channel for transferring money,” he underscored.

Relying on new income sources such as non-oil exports, tourism, divesting state-run shares to the private sector as well as creating new banking channels is the new track on which the Iranian government is moving:

Based on the data released by the Islamic Republic of Iran Customs Administration (IRICA), The value of Iran’s non-oil exports during the first eight months of the current Iranian calendar year rose 13 percent from $46.931 billion in the past Iranian calendar year of 1396 i.e. the country exported 75.27 million tons of non-oil products worth $31.491 billion during the eight-month period.

More than 4.7 million foreigners traveled to Iran during the seven months to October 22, 2018 thanks to the lower costs of Iran travel packages and despite negative image created by the U.S. and the Iranophobia project, according to Ali Asghar Mounesan, the head of Iran’s Cultural Heritage, Handicraft and Tourism Organization. The number shows a growth of 56 percent in total number of foreign visitors compared with the same period last year. A new report on global security, 2019 Travel Risk Map prepared and launched by global risk experts International SOS in collaboration with Control Risks, has portrayed Iran as safe as much of Western Europe for travelers in what could be an evidence that the country’s tourism industry has a good potential to provide a serious source of revenues in face of stringent U.S. sanctions. Iran plans to attract 20 million tourists per annum by 2025 in order to generate $30 billion of revenues as the country seeks to wean itself off the oil money. As planned in 1398 budget bill, the government is to increase the granted budget to tourism sector for 100 percent.

As reported in late September, Iranian Privatization Organization (IPO) has announced that privatization in Iran witnessed 100 percent growth during the first five months of the current calendar year and IPO offered 20 trillion rials (about $476 million) of state-run shares to the private sector in this period.

The good news came on Monday when the CBI governor Abdolnaser Hemmati announced that Iran has made mutual monetary agreements with some countries on the way to abolish U.S. dollar in its financial transactions and the issue will be incrementally generalized to other countries in future.

Iran is abandoning dollar along with India, Russia, China and the EU, the act which is hoped to isolate the U.S. dollar as a global currency, preventing it from utilizing its currency as an unparalleled diplomatic and economic power in a globalized world.

HJ/MA

Leave a Comment