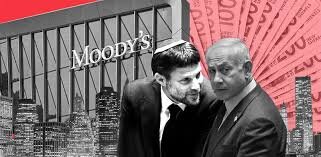

Behind closed doors: Israel scrambling to avert another economic crisis

TEHRAN – In a stark condemnation of the Israeli government's policies, Moody's Investors Service, a global credit rating agency, has downgraded Israel's sovereign credit rating, sending shockwaves through its financial landscape. This move, driven by concerns over the deepening political and economic instability fueled by the government's aggressive actions, has raised serious alarm bells about the uture of the Israeli economy.

Moody's, renowned for its meticulous analysis of global financial markets, cited "weakening governance and institutional strength" as the primary factors behind the downgrade. This decision, a stinging rebuke to the current administration, underscores the growing international perception of Israel's leadership as increasingly erratic and reckless.

At the heart of this downgrade lies the Israeli government's persistent military aggression in the occupied territories, as well as its warmongerings in other regions including south Lebanon. The ongoing conflict, marked by escalating violence and a disregard for international law, has strained relations with key allies, leading to a growing diplomatic isolation. The continued occupation, coupled with the expansion of settlements, has not only eroded Israel's international standing but also contributed to an atmosphere of instability that has driven away investors and undermined confidence in the Israeli economy.

The downgrade, however, extends beyond the geopolitical implications. It reflects a deeper, more systemic crisis within Israel's political structure. The current government, characterized by its extreme right-wing ideology, has been plagued by internal divisions and a lack of consensus on key issues. This political gridlock, coupled with a growing sense of societal polarization, has created an environment ripe for instability and economic uncertainty.

The economic repercussions of this downgrade are dire. The loss of investor confidence will likely lead to a decline in foreign direct investment, a crucial driver of Israel's economic growth. The cost of borrowing for businesses and individuals is expected to rise, further dampening economic activity. In the long term, this downgrade could potentially impact the Israeli shekel's value, leading to higher inflation and a decline in living standards.

The downgrade has also exposed a crucial vulnerability within Israel's economic model. Despite its technological advancements and vibrant startup scene, the Zionist regime remains heavily reliant on foreign capital and investment. This vulnerability has been exacerbated by the government's political choices, leaving Israelis exposed to the whims of international markets and susceptible to negative ratings like the one issued by Moody's.

Critics of the government have been quick to point the finger at the current leadership, accusing them of sacrificing long-term economic stability for short-term political gains. While the government has attempted to downplay the significance of the downgrade, the damage is already being felt. The Israeli stock market experienced a sharp decline following the announcement, reflecting investor anxiety and uncertainty.

Adding to the already precarious situation, whispers are circulating that Moody's is on the verge of releasing its updated ratings, and informed sources indicate that Israel's ranking has suffered another downgrade. Reports suggest that Israeli authorities are engaging in frantic, round-the-clock negotiations in an attempt to avoid the publication of this new, potentially devastating, assessment. The weight of these looming ratings hangs heavy over the Israeli economy, threatening to further unravel its already fragile financial stability.