NIOC to offer $476m worth of oil in IRENEX via salaf bonds

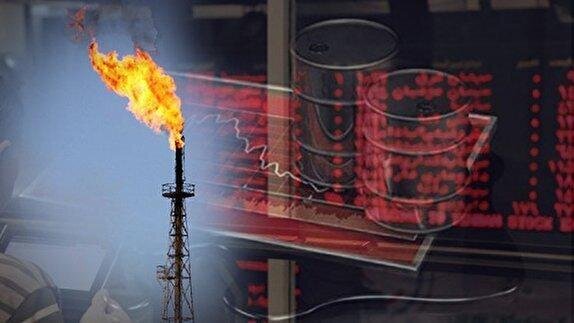

TEHRAN - The National Iranian Oil Company (NIOC) plans to offer 20 trillion rials (about $476.1 million) worth of heavy crude oil in Iran Energy Exchange (IRENEX) through standard parallel salaf contracts (some kind of Islamic contract) on Sunday, the exchange’s managing director told IRNA.

According to Seyed Ali Hosseini, the fund raised through this offering is going to be used to finance the oil industry’s development projects.

“National Iranian Oil Company is the issuer of the salaf bonds and the purpose of this offering is to finance the company’s development projects and its current expenses; the offering will be conducted under two separate indices,” Hosseini explained.

A standard parallel salaf is an Islamic contract similar to futures, with the difference being that the contract’s total price must be paid in advance.

Hosseini noted that each salaf contract has an equivalent value of one barrel of heavy crude oil which is priced at 9.446 million rials (about $224) in Iran.

Mentioning the difference between the initial public offering of parallel Salaf contracts and a plan proposed by President Hassan Rouhani called oil pre-sale (or economic evolvement), the official said the president’s plan is currently going through the expert assessment processes and is not yet finalized.

This plan will also be implemented and the shares will be offered at the energy exchange as soon as it is approved by the relative assessing bodies, he added.

According to Hosseini, since the Iranian calendar year 1394 (March 2015-March 2016), the private sector and the government have repeatedly financed their projects through offering standard parallel salaf contracts for basic assets like heavy crude oil, light crude oil, gas condensate, gasoline, fuel oil, and electricity, through the energy exchange.

IRENEX is a commodity exchange in Iran in which physical energy carriers (oil, gas, electricity) and commodity-based securities are exchanged.

EF/MA