Energy Dominance?

U.S. presidents have promoted the idea of American 'energy independence' for decades as a solution to the geopolitical issues that led to volatile energy prices — meaning the U.S. would produce enough energy to supply itself without having to rely on foreign exports.

President Trump's major 'Energy Week' speech on 29th June 2017 scrapped that line in favor of what during he called it "energy dominance." This is an historic change in US foreign policy doctrine and language.

Historically the US policy aim has been for Energy Independence whereby the US becomes independent of foreign energy producers. However, we heard from President Trump for the first time a new US rhetoric of Energy Dominance. What exactly this consists of was not made clear by the President but it appears that the US now aims to dominate global energy market pricing through the export of shale oil and gas.

I find it useful to view President Trump's actions as though he is the Chief Executive Officer of US Incorporated, and through that lens Trump's Chief Operating Officer (and one of the authors of Trump's speech) is Gary Cohn, Trump's chief economic adviser, who is formerly President and COO of Goldman Sachs, with decades of trading experience at the highest level.

The ICE Age

Towards the tail end of the Dot Com boom in 2000, Gary Cohn had dinner with his counterpart at Morgan Stanley, John Shapiro, and they hatched an audacious plan to take control of the global oil market through the creation of a new global electronic market platform.

The two investment banks acquired a moribund mid-American electronic trading system and its dynamic founder (Intercontinental Exchange - ICE) – and then recruited key oil market players (including BP, Shell & Total) who agreed to provide trading liquidity in exchange for a share of ICE equity ownership. More ICE market participants were then rapidly signed up, and after an abortive effort to acquire the New York Mercantile Exchange (NYMEX), ICE made the members of London's International Petroleum Exchange an offer they could not refuse: either sell your exchange to us, or we will cease to use your exchange.

Meanwhile in the North Sea, the new flow of BP's Forties grade of crude oil was added to the declining flow of crude oil from Shell's Brent field which had become the preferred benchmark for the global oil price, and the improved contract soon left behind the US West Texas Intermediate (WTI) price as a purely domestic US benchmark price.

Oil as an Asset

Over the 15 years that followed this ICE energy market coup, the oil market price ceased to be set on the basis of oil priced as a useful commodity. Instead oil became financialised through being priced as an asset class, as risk averse investors invested in oil through passive funds as a means of protecting the value of their savings from inflation.

The sheer scale of the oil market's departure from reality is demonstrated by the astonishing fact that in the two years from mid-2007 to mid-2009 while the oil price on the ICE casino gyrated from $80 to $147 to $35 and back to $80 per barrel, physical oil market demand in the real world varied by less than 3%.

At this point President Obama – a Wall Street President – came to office and began the market strategy I term the Big Long.

The Big Long

Saudi capital was invested in the oil market via a fund using the same prepay instruments with which Enron successfully defrauded creditors and investors for a decade. The effect was that the Saudis lent dollars to the US in exchange for borrowing (purchase and resale) oil stored in the US. In this way the Obama administration was able to inflate and maintain the oil price above $80/barrel, subject to Saudi agreement to supply oil if necessary to limit the US gasoline price. Meanwhile Saudi petrodollars continued to fund the US deficit as they had since 1974.

As a result of an oil price maintained between $80 to $120/bbl the US was able within 3 years not only to increase oil production by 5m barrels per day but also to reduce oil product use by 2m bpd. So by 2015 the US found themselves – as was Obama's intention – free of reliance on Saudi Arabia for the first time in 44 years. Meanwhile the US pivoted towards the last remaining undeveloped low cost reserves in Iraq and Iran, while developing and safeguarding Qatari LNG production.

I believe that a Clinton administration would have largely continued Obama's strategy (of which a great deal more could be written), but the unexpected victory of President Trump in November 2016 changed everything.

Energy Dominance

On 30th June the BWAVE formula which Saudi Arabia had used for over a decade to price European oil (and against which all other destinations were then priced) ceased operation.

This formula was based on a daily weighted average of trading in the ICE BFOE (Brent, Forties, Ekofisk, Oseberg) futures contract. The BWAVE methodology allowed market price support through High Frequency Trading on the ICE electronic market system. However, the underlying physical market was always subject to the trading games played by oil companies such as BP and Statoil in particular which often led to excessive volatility.

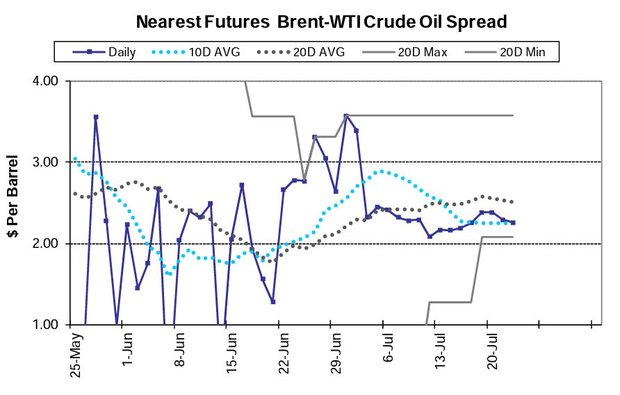

So on 1st July 2017 Saudi Arabia switched from BWAVE pricing to the daily ICE Brent/BFOE Futures settlement price instead, which now enables the US WTI market tail to wag the global Brent/BFOE physical market dog.

This image shows the striking change in the relationship between the two contracts which took place.

In my analysis, the intention of the US is to print dollars as necessary to fund new shale oil and gas production. The calculation is that even if shale oil investors go bankrupt (as many did after the 2014 price crash) the banks will still have debt secured against intrinsically valuable oil, which the Fed will then if necessary swap for dollars via the Quantitative Easing programme. The proposal to appoint Gary Cohn as the next chairman of the Federal Reserve Bank is probably related to this.

In a nutshell, I believe US Incorporated intends to monetise not only US reserves of oil, but also the reserves of what is essentially a new subsidiary of US Incorporated – Saudi Arabia Inc, with a new and youthful Chief Executive Officer, Mohammad bin Salman (MbS).

The aim of the US Energy Dominance strategy appears to be for the US to rebase the dollar firmly upon oil, and to create a two tier oil market in which US antagonists such as Iran and Russia participate on inferior terms if at all.

Why Energy Dominance will Fail

As the former Saudi oil minister Yamani said, the Stone Age did not end for lack of stones and the Oil Age is not ending for lack of oil but for the simple reason that the energy return on energy invested (EROEI) to produce a barrel of oil is in a secular decline.

Although the narrative used by the Saudis to rationalise their strategy has changed from market share to cutting oil inventory, both of these explanations are merely outcomes of a Saudi strategy to maximise dollar profits by sophisticated cheating invisible to the market.

However, it is said that sunshine is the best disinfectant and new tools are now bringing transparency to the oil market. Tanker Trackers www.TankerTrackers.com demonstrate the fact that oil tankers can't run, and they can't hide. Tanker Trackers data indicates that China has added over 800m barrels of oil to inventory since 2013 https://pbs.twimg.com/media/DE7MmgjXcAAovIi.jpg:large

Indeed, in four months to June 2017 China has added to reserves at the rate of 1.5m barrels per day, which sheds a different light on the market and the Saudi inventory narrative. According to Samir Madani of Tanker Trackers, China's inventory has now reached a level between 80% and 90% of capacity at which it becomes difficult for operational reasons to accommodate more oil

So it appears to me that any attempt by the US to support the oil price at current levels for long enough to facilitate the Saudi Aramco IPO will fail as China ceases to act as Buyer of Last Resort.

Energy First

What should be the response of the rest of the oil market to such an audacious 'America First' US strategy of Energy Dominance?

One approach could be for Iran and Iraq to jointly create a Middle East oil price benchmark as my colleague and I recommended to Iran's late Central Bank Governor Nourbakhsh in 2001 and which led in 2004 to the abortive and almost mythical Kish Oil Bourse.

But the oil market has moved on to a point approaching 'Peak Demand' and my recommendation to Iran, her neighbours and other Eurasian countries is to deploy what Iran's Oil Minister Bijan Zanganeh terms Energy Diplomacy.

The rationale for energy diplomacy is simple: it does not matter what ideological or religious differences exist between nations, it will always make sense to cooperate to conserve finite resources such as water and fossil fuels.

I believe that the time is now ripe for new global energy institutions such as an Energy Clearing Union to be founded as a framework for generic energy swaps and energy credits.

So rather than destructive America First policies or an avaricious EU First policy, or simply self-defeating Iran, Russia or China First policies perhaps we will see Energy First – by which I mean a transition from a global market paradigm of oil and gas as a commodity to a new market paradigm of energy as a service, and from dollar or euro economics to energy economics.

Chris Cook was a market regulator at the Association of Futures Brokers & Dealers, and then at the International Petroleum Exchange (latterly as a Director). Mr. Cook s now works mainly in Scotland, with Nordic Enterprise Trust, to develop new partnership-based enterprise models, and related financial products and services.